what percentage of taxes are taken out of paycheck in nc

Taxes Forms. You must pay estimated tax if you dont have your tax withholding taken out by an employer or if you are self employed.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

So your vast majority of taxes these guys are paying is actually under 50.

. If a reverse mortgage lender tells you You wont lose your home theyre not being straight with you. You can request for any type of assignment help from our highly qualified professional writers. Individual income tax refund inquiries.

If you are a resident of North Carolina or otherwise need to file Form NC-400 reference these. Structured rule for HR. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

The top 1 of filers - AGI of 546K or more pay 3877 of US taxes. TITLE V--COMMITTEE ON SMALL BUSINESS AND ENTREPRENEURSHIP Sec. In addition to withholding federal and state income tax you also need to withhold federal social security and Medicare taxes from your employees wages.

However if you are self-employed you must pay both the employer and the employee taxes or 124. Used to collect taxes by seizure of taxpayers assets. I recently turned 18 and dont have any credit.

And he cited Bloombergs philanthropic giving offering the calculation that taken together what Mike gives to charity and pays in taxes amounts to approximately 75 of his annual income. You absolutely can lose your home if you have a reverse mortgage. You Could Lose Your Home.

Check out the top FAQs potential customers ask DriveTime. The money that goes into these accounts comes out of your paycheck before taxes are deducted so you are effectively lowering your taxable income while saving for the future. In other words if you work for someone else you pay 62 of your income as Social Security taxes and your employer matches this amount.

If you pay for your policy with pre-tax dollars usually directly taken out of your paycheck then youll also have to pay taxes on any disability benefits you receive. Using a different set of tax brackets the IRS taxes these net capital gains at much more favorable rates that ordinary income. Employee contributions are deducted from your paycheck and can be made either on a pre-tax basis or an after-tax basis or a combination of both.

When you make money from selling a house or property your capital gains tax depends on whether you lived in the house and how long you lived there. B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not. There is appropriated to the Secretary of Agriculture for fiscal year 2021 out of any money in the Treasury not otherwise appropriated 4000000000 to remain available until expended to.

Modifications to paycheck protection program. Basis point basis point one one-hundredth 1100 or 001 of one percent. Your budget is too tight you cant afford your day-to-day bills and.

I got a big concern I live in north Wilkesboro and drive time is in charlotte NC no one will take me there. The corporate income tax will also see a reduction from 6 percent to 4. Accordingly the rate in each individual income tax bracket will lower by 025 percentage points dropping the top rate from 5 to 475 percent.

636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F. I also DO NOT have a cosigner. In other words there are roughly 118 million millionaires in America making up roughly 35 of the population in 2021.

Be informed and get ahead with. Tax rates starting in tax year 2022. Flip the Script Earlier this cycle a seasoned Democratic strategist argued that his partys success in the midterms wouldnt be predicated on policy successes but by turning out the 20182020 coalition of anti-Trump voters.

2021 capital gains tax rates. If you want to get to the actual vast majority. Retirement accounts like a 401k and 403b not only help you save money for your future but can also help lower how much you owe in taxes.

Pre-tax means before federal income tax is calculated. Think about the reasons you were considering getting a reverse mortgage in the first place. Frequently funds are seized from bank accounts or wages.

Provides one hour of general debate equally divided and. The top 20 - AGI of 103K or more pay 82 of US taxes. Taxes youll pay in 2021 to be filed on your 2022 tax return.

All your academic needs will be taken care of as early as you need them. In the case of variable or step-rate securities the addition or subtraction of a certain coupon rate differential over a benchmark. The top 2 - AGI of 364K or more pay 4684 of US taxes.

For 2016 you are required to withhold 62 for social security taxes and 145 for Medicare taxes. Individual Income Tax Sales and Use Tax Withholding Tax Corporate Income Franchise Tax. A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020.

We provide assignment help in over 80 subjects. REPORTED BY A RECORD VOTE of 9-4 on Tuesday July 18 2022. This count is at a record high thanks to a long bull market in stocks bonds and real estate.

For example if you bought a house years ago at 200000 and sold it for 300000 youd pay a percentage of your 100000 profit or capital gains to the government. Schedule A includes fields for deducting local income and property taxes a percentage of qualifying medical expenses. F Participation in the paycheck protection program--In an agreement.

A In General--Section 7a of the Small Business Act 15 USC. A claim on the property of a taxpayer as security against payment of taxes due. We are a leading online assignment help service provider.

And B by adding at the end the following. Taxes Forms. Used to express the yield benchmark formula benchmark formula a formula to determine a performance standard against which a bond or other security can be measured.

While there are many ways to show how much is collected in taxes by state governments. Agreed to by record vote of 219-200 after agreeing to the previous question by record vote of 219-199 on July 19 2022 MANAGERS. Employee-sponsored disability insurance benefits are considered a form of income and will be taxed according to the federal income tax rates.

Individual Income Tax Sales and Use Tax Withholding Tax Corporate Income Franchise Tax. Read our complete guide to capital gains taxes. As a result your income tax is based on a lower amount of pay so you pay less current tax.

Use your gross pay your pay before any taxes are taken out for this calculation. Individual income tax refund inquiries. Withhold federal social security and Medicare taxes.

I only make about 765 a month before taxes but i currently pay 300 a month for my car now. FLOOR ACTION ON H. Before learning about your chances of becoming a millionaire lets find out roughly how many millionaires there are in America.

Entering green edited money amounts from source documents into listing machines while preparing Form 813 Document Register for Manual. You will not have to pay taxes on your pre-tax.

North Carolina Income Tax Calculator Smartasset

New Nc Laws For 2022 Include Lower Taxes And A Focus On Police Officers Mental Health Wfae 90 7 Charlotte S Npr News Source

North Carolina Income Tax Calculator Smartasset

The Facts On Teacher Pay Public Schools First Nc

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Paycheck Calculator Smartasset

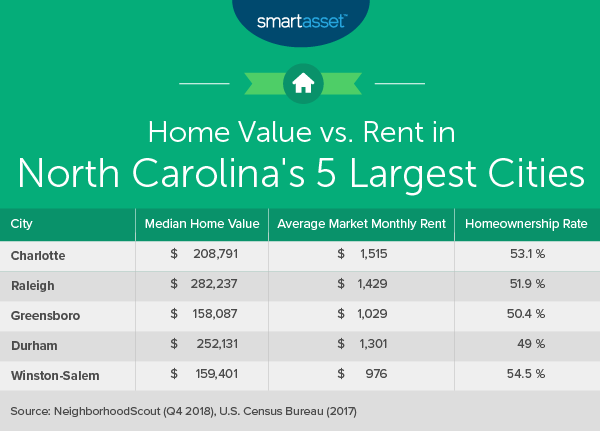

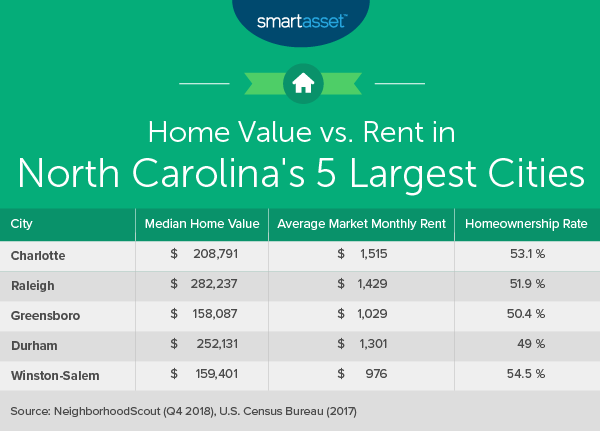

The Cost Of Living In North Carolina Smartasset

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

North Carolina Paycheck Calculator Smartasset

Taxidermist Salary In Charlotte Nc Comparably

Subsidized Reimbursed Child Care Family Forward Nc

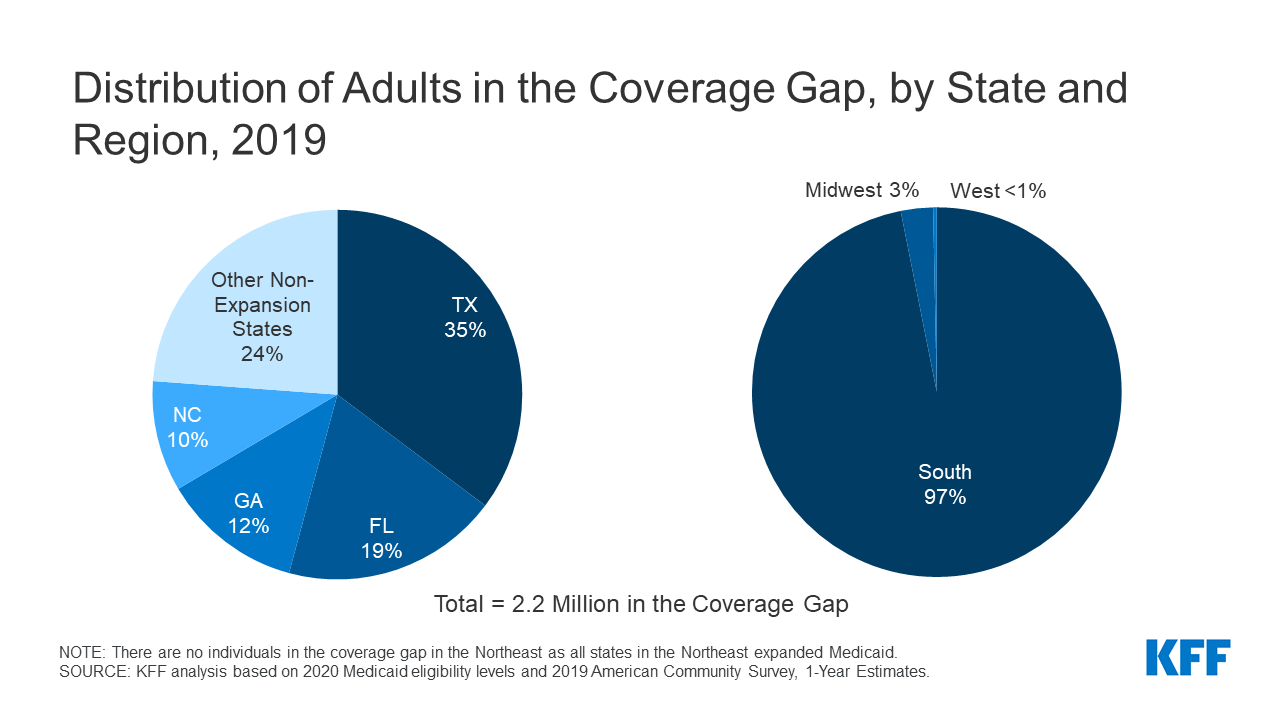

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

How The Tax Cuts And Jobs Act Is Helping North Carolina Americans For Tax Reform

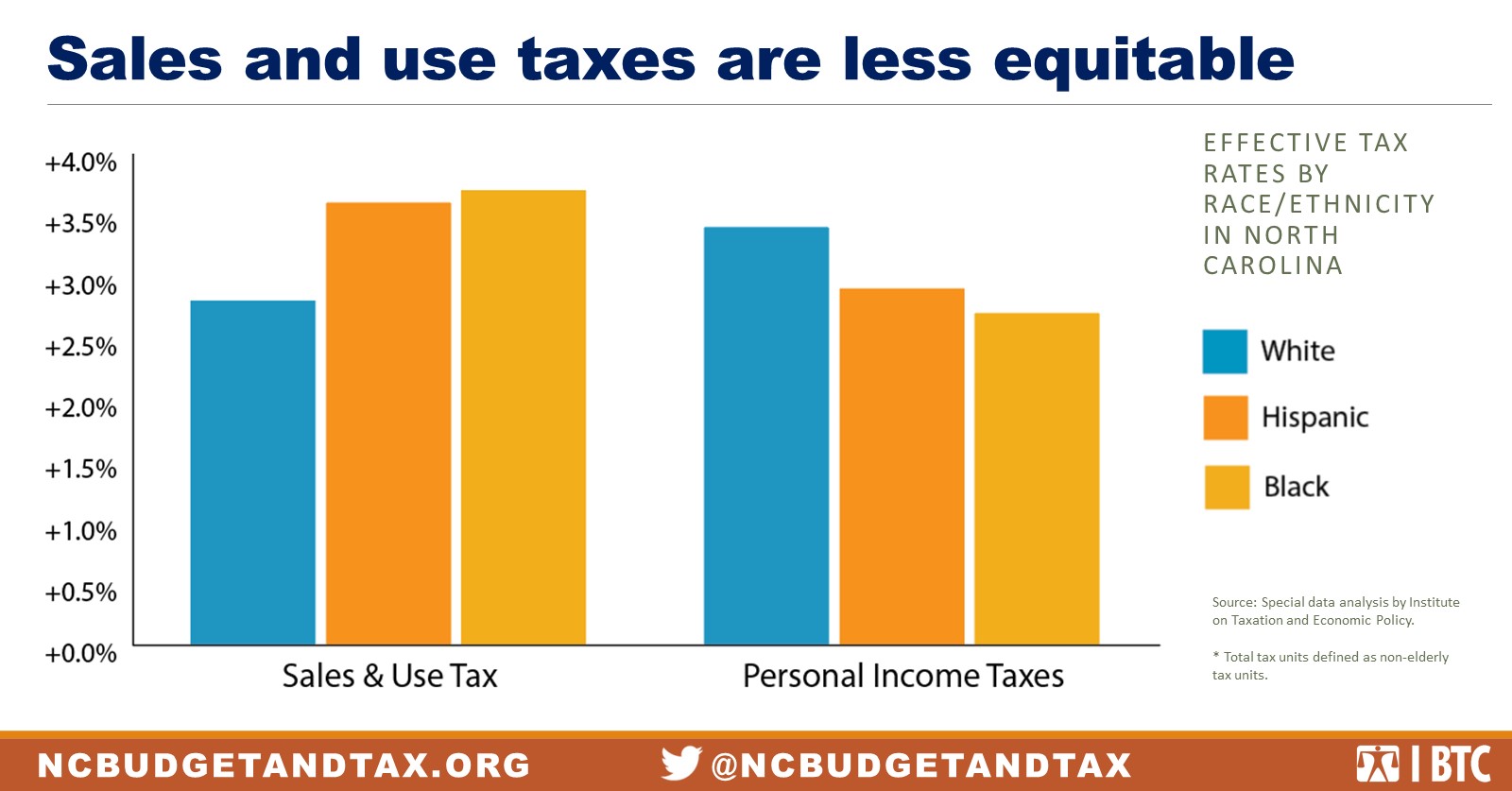

State Tax Policy Is Not Race Neutral North Carolina Justice Center

The Facts On Teacher Pay Public Schools First Nc

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation